There is definitely some sort of Zen that makes Apple, well, Apple. Taking something obvious, and making it somehow better, somehow cooler, somehow new. How do they do it? By observing how consumers interact with technology and experimenting ad nauseum internally, until they get it exactly the way they want it. This includes abandoning the past if it no longer makes any sense. So when Apple’s own Tim Cook declares that merging a refrigerator and a toaster is not good for the consumer, he may just have a point.

But as forward-thinking as the company is, perhaps Apple hasn’t created a new path at all. Through a technique of observe, perfect and discard, Apple has been heading for some time now in one direction — along the pre-defined path into the era of ubiquitous computing.

Ubiquitous computing defined

In some ways, this path is as logical as Moore’s Law. Look at the history of computing — from the mainframe era where there was one computer for many consumers, to the personal computing era where there was one computer for each consumer, to this new era where there are many computers for each consumer – and compare of the number of computer chips to the number of consumers using those chips. At its foundation, ubiquitous computing could be summed up by this simple principle of ratios.

The modern concept of ubiquitous computing originally came from Mark Weiser in 1988 from the Computer Science Lab at Xerox PARC (sound familiar?). The theory proposed a seamless, almost invisible connection between consumers and computers that would help drive a change in ratios from one computer to many people, to many computers to one person.

Apple’s tabs, pads and boards

Even considering the most radical interpretation of ubiquitous computing dust, the main point has remained the same. We will soon be overrun by computer chips. There are, however, three very distinct platforms in this well-defined post-PC era that we have all become accustomed to. Not unlike the three platforms we see evolving within the iOS platform today:

Gesturing tabs: Mobile technology already had small chips, powerful batteries, geolocation services and wireless networking. But that was not enough to win over the masses and drive us all to purchase multiple computing devices. It was the way consumers interacted with these smaller devices that needed to change. For a long time, it was thought that voice recognition was going to propel us into the next era of computing, but that never happened.

Leveraging the fact that there were approximately 100 million iPod users, Apple was able to use convergence to its advantage as it introduced these iPod users to a series of simple touch-based gestures on a nearly buttonless device. In the early years of the iPod, we all were trained on the scroll wheel. With touch-based gestures on a wide open screen, this paradigm was taken one step further. Just as the mouse accompanied the transition from the terminal-based Mainframe Era to PC era, the post-PC era was ushered in by a new way of interacting with other computer chips, touch.

Revolutionary pads: As soon as people became familiar with this new way of interacting with computers, it was time to challenge the personal computer paradigm directly. Netbooks attempted to continue the personal relationship with consumers by maintaining the 1:1 ratio. Tablets such as the iPad are more specialized and were never meant to be a total replacement for a traditional and general purpose personal computer.

The rapid rise and immediate success of the iPad was proof positive that consumers were ready for a third major computing device in their lives. With “pads” being used by pilots, students and doctors and in restaurants, kitchens and at work, the iPad was proving to be a specialized place-based appliance rather than a personal computer with a more general purpose. As powerful as the third generation iPad is, it will never replace the personal computer, just as the personal computer never really replaced the mainframe.

Experimental boards: The current AppleTV may be a stretch to accept as a computing platform as it has no keyboard, no mouse, no touch display, and just a very simple IR remote. That is unless you happen to be near one with a Mac or iOS device. Then the AppleTV becomes an extension of that device on a much larger screen. Although it is marketed along side the iPod, it is just as closely related to the Airport Express. Perhaps Apple needs to look towards Nintendo’s Wii or Microsoft’s Kinect, otherwise the AppleTV will be doomed as just an accessory to their Tabs and Pads.

Take a look at what HBO has done with the XBox Kinect as an example. If Apple’s recently awarded gesture based patents are any indicator, this may be where it is headed as well. The interaction between consumer and computer chip has not been ironed out enough to fully see this final platform — the boards of ubiquitous computing — take hold of our day-to-day life.

One human relation-chip

Making each device “aware” of how consumers use all of the other devices they own is the key to accelerating the adoption of more than one computing device. While Apple may in fact be the only company in the world to have constructed a homogeneous synergy between its personal and its ubiquitous computing platform, it is certainly not the only company trying to forge the relationship between the user and the computer chip. For the relationship between consumers and computing devices to become truly invisible, these new smart devices will need to know more and more about the consumers who own them. For instance, the devices will need to know everything consumers have done in the past, what they are doing now and even what they plan on doing later.

Perhaps this is the reason Tim Cook stated that Apple’s “best years lie ahead of us.” With technologies like iCloud and Siri, Apple will likely play a larger and larger role in forging the relationship between consumers and the growing number of computing devices in our daily lives. It is not about selling more of these individual devices, it is all about enabling the relationship between an individual and a collection of specialized devices. And Apple knows this.

Related research and analysis from GigaOM Pro:

Subscriber content. Sign up for a free trial.

- Forecast: Tablet App Sales To Hit $8B by 2015

- Social media in Q1: commerce and discovery dominated

- Controversy, courtrooms and the cloud in Q1

Sunday, April 29, 2012

Apple’s inevitable path to a post-PC era — Apple News, Tips and Reviews

Apple squared, (four)squared — Tech News and Analysis

I was down in Soho last week, visiting (of course) the new Manhattan REI store. After the shopping spree, I pulled out my iPhone and found a dinner recommendation on Explore: five of my friends had eaten at La Esquina, several of them more than once. Bingo. I go and get some (delicious and a tad pricy) tacos, and pay the check by giving my full name to the waiter, checking into Foursquare in the process, without ever pulling out my iPhone.

At least part of that story is real, and Apple can make the second part real very soon if they use their $110 billion pile of cash to acquire the two companies that will help them get control of the local point-of-sale market, everywhere. Yes, I am suggesting that Apple acquire both Foursquare (let’s say, at a $1 billion to $2 billion valuation) and Square (currently evaluated at $4 billion, more or less). Paying a premium on both, Apple could keep it at $10 billion between them.

And what does Apple get?

A complete take over — and a true overhaul — of the local point-of-sale market. How much is it worth? Nobody can tell for sure. To give some examples, according to IBISWorld the grocery store market alone is worth an estimated $491 billion annually and convenience stores are a $51 billion market (a subscription is needed to view these reports). As Jason Calacanis wrote recently, if iPhones accounted for one percent of restaurant sales, that would be $6 billion of the $604 billion spent in 2011.

Apple-Foursquare-Square could jumpstart Apple on its way to take over a major part of the transactions in these (and many other) industries. Let’s look at what all three companies get out of this:

Apple gets:

* An immediate presence in the POS market, including merchant relationships. And it will get a platform for local payments that connects to the 200 million strong credit card database the company already has.

* The holy grail of advertising: conversion information. Apple will gain the ability to track customers from search and (even better) iAds to a point-of-sale purchase. We can only imagine how much that’s worth (read: a good chunk of Google’s business).

* Superior local search. Foursquare Explore continues to get better, and it is inherently social — ages ahead of any local search that exists today. Explore has been consistently improving, even outside of such major markets as New York City. If your friends are on (and if they have an iPhone, they will be if after this move), no other service can give you better personalized information about local businesses.

* A development team that is social to the core. Apple has long been accused of lacking “social DNA.” The Foursquare folks could be the seed of social at Apple — even beyond the location sharing — just like Flickr was the seed of social at Yahoo (well, maybe not).

Foursquare gets:

* More checkins and better information. Checkins should be implicit for every single purchase made, creating an immediate personal history. And if you haven’t checked in yet, then there should be an option to “explicitly” check in (i.e. broadcast to friends) when you make a purchase. More data means better recommendations, and it also makes additional services possible, not to mention better user modeling for marketing purposes.

* Easier integration for loyalty, business deals and coupons. Benefits could be factored right into the payment.

* Hundreds of millions of additional users from pre-installed iPhone clients. Additionally, other applications will be able to work with logins and data using device-level integration (similar to Twitter’s integration into iOS).

Square gets:

* 200 million pre-installed devices with credit card details already attached through customers’ Apple Store accounts, i.e. zero client acquisition cost.

* Hundreds of millions of devices equals a great motivation for merchants to sign up.

To summarize: after the deal, Apple will immediately become a giant payments company, with an installation base that is expected to encompass half of all mobile devices sold. The company will have the best local search abilities, far exceeding any existing recommendation engine. And due to its enormous reach, it will possess a payment system that merchants will line up to support. Who’s betting against this holy trinity? Not me.

Mor Naaman (@informor) is an assistant professor at Rutgers University where he directs the Social Media Information Lab. He is the co-founder and chief technology officer of Mahaya.

Image courtesy of Flickr user miamism.

Related research and analysis from GigaOM Pro:

Subscriber content. Sign up for a free trial.

- Connected world: the consumer technology revolution

- Forecast: Tablet App Sales To Hit $8B by 2015

- Social media in Q1: commerce and discovery dominated

Very interesting suggestion. Unfortunately it will not happen. Apple, is by nature, extremely conservative in its acquisitions. This would mark a huge turning point in its direction and would invite the scrutiny of the DOJ.

No, AirPlay Is Not The New Apple TV | TechCrunch

Editor’s note: David McIntosh is the founder and CEO of Redux, a fast-growing video discovery company. Redux is the top downloaded app on Google TV, and you can read David’s other guest posts here.

If you asked your mom or dad what DLNA or UPnP stood for or did, would they just look at you weird? While the two technologies enable users to wirelessly beam content to Internet Connected TVs from their tablets, phones, and computers, Apple’s AirPlay is the first implementation that makes the experience seamless. Tap the button again and playback resumes on your root device. No complicated setup is required – it simply works.

Some, like Bloomberg and Hunter Walk, have suggested that AirPlay is Apple TV, and that Apple will simply license AirPlay to the major Connected TV manufactures – and by default every Connected TV sold will be an “Apple TV” – the remote being your iPhone or iPad. It’s certainly a sensible theory – there are 250 M+ iOS devices, and with the upcoming OS X update, laptops can now leverage Airplay as well. That’s over 300M Apple devices that can push content to TVs.

Fragmentation is the reality

That level of integration would be a dream come true for many networks, studios, and cable companies looking to sell a “TV Everywhere” experience directly to users. Simply integrate with an iOS app, and with one tap consumers can watch content on hundreds of TV devices. Today it’s a big competitive advantage to be able to offer a consistent and incredible TV experience across hundreds of devices. Netflix built its early lead around that competitive advantage, and many networks, studios, and cable companies are looking to build technological solutions to combat fragmentation so that they can compete with Netflix. A content network or studio needs to be able to deliver a discovery and consumption experience better than Netflix’s across just as many devices — otherwise the consumer will turn to Netflix.

A ubiquitous AirPlay integration would level the playing field considerably, but is unlikely for several reasons:

(1) AirPlay adoption is not wide yet. There are less than 5M Apple TV units in the market, which means that today there are less than 5M users in the market that use Airplay for video.

And while Apple is heavily promoting AirPlay-video-enabled apps in the iTunes store, wide consumer adoption is unclear. Unfortunately, stats on Airplay usage aren’t widely available, but anecdotally – in my group of friends I’m the one evangelizing it – many Apple TV owners I meet don’t even realize AirPlay exists.

(2) Manufacturer adoption will be slow. Given that AirPlay does not have a critical mass of users, it’s hard to imagine how in the short-term Apple will convince any of the top five TV manufacturers to adopt AirPlay. Margins on TVs have been decreasing over time, and manufacturers are looking to integrate Connected TVs into an ecosystem of higher-margin tablets and phones. Integrating AirPlay,while it may sell more TVs (when Airplay has critical mass) will reduce sales of higher-margin tablets and phones they could have sold that exclusively interfaced with their TVs.

(3) A seamless experience is unlikely. It’s unlikely video AirPlay would be integrated consistently across all Connected TVs to create the same seamless experience consumers have with an Apple TV today. DLNA is a good example. It’’s an open protocol that in theory should accomplish what AirPlay does, except it’s implemented inconsistently across devices and often doesn’t work at all. Unless Apple has full control of the software layer, simply licensing out AirPlay would not achieve the desired experience.

Apple can overcome the issue of critical mass with enough of its own Apple TV units in the market. But at the pace of sales for its existing Apple TV, it will be years before AirPlay would have the usage to give Apple the clout to get integrations with other manufacturers. That’s why the rumors of an upcoming integrated Apple TV or upgraded device make sense. While AirPlay may be the long-term bet, in the short-term Apple needs a critical mass of users airplaying content to their TV. And AirPlay may be a central part of the rumored AppleTV. It wouldn’t be surprising if Apple uses their new device to train users how to use AirPlay. At that point, AirPlay could become a must-have for other TV manufacturers. As a TV manufacturer you would lose sales by not having it integrated.

But even with a critical mass of AirPlay users in the market, it’s still unclear whether Apple could convince many manufacturers to adopt AirPlay, or would even have success getting them to implement it the way it’s implemented in Apple TV. That’s why Apple owns the hardware and software layer; they can create experiences that would never be created by leaving third-party manufacturers to their own devices.

Winners in TV will have technological solutions to fragmentation

What’s more, a fragmented approach to DLNA and Connected TV has already developed. Just as the Android ecosystem is increasingly fragmented, while iOS is uniform, the Apple TV of the future will be nicely unified with other iOS devices through AirPlay, whereas other Connected TVs will have fragmented platforms with fragmented DLNA protocols.

That means that succeeding in the fast-growing Connected TV ecosystem will require a killer approach to fragmentation. Leading cable companies, and networks looking to sell directly to consumers will have to sit on top of iOS’s uniform AirPlay platform, as well as a highly fragmented Connected TV and DLNA platform to reach meaningful scale.

There’s also the issue of whether or not Apple can strike a deal with Hollywood and other content creators but that’s a story for some other time.

I don't necessarily agree with David's assertion that TV manufacturers won't integrate Airplay into their sets. Many of the top audio gear has already done it so I don't see why TV manufacturers wouldn't (except that many of them are trying, with very little success, to build their own ecosystem with apps). As far as consistent support, Apple has traditionally been very good at enforcing good implementations if the manufacturer is to state that their device is 'AirPlay' enabled. I think this would be a smart route to go but I think the TV manufacturers are reluctant only because they would be ceding the entire app market to Apple by doing so.

The A/B Test: Inside the Technology That's Changing the Rules of Business | Epicenter

.ab_strike { color: #000000; font-size: 1.3em; font-weight: bold; margin-bottom: 5px; text-decoration: line-through; }

Illustration: Si Scott

You have to make choices.

Choose everything.

The online payment platform WePay designed its entire homepage through a testing process. “We did it as a contest,” CEO Bill Clerico says. “A few of our engineers built different homepages, and we just put them in rotation.” For two months, every user that came to WePay.com was randomly assigned a homepage, and at the end the numbers made the decision.

In the past, that exercise would have been impossible—and because it was impossible, the design would have emerged in a completely different way. Someone in the company, perhaps Clerico himself, would have wound up choosing a design. But with A/B testing, WePay didn’t have to make a decision. After all, if you can test everything, then simply choose all of the above and let the customers sort it out.

For that same reason, A/B increasingly makes meetings irrelevant. Where editors at a news site, for example, might have sat around a table for 15 minutes trying to decide on the best phrasing for an important headline, they can simply run all the proposed headlines and let the testing decide. Consensus, even democracy, has been replaced by pluralism—resolved by data.

The mantra of “choose everything” also becomes a way for companies to test out relationships with other companies—and in so doing becomes a powerful way for them to win new business and take on larger rivals. In 2011 a fund-raising site called GoFundMe was talking with WePay about the possibility of switching to its service from payment giant PayPal. GoFundMe CEO Brad Damphousse was open about his dissatisfaction with PayPal’s service; WePay responded, as startups usually do, by claiming that its product solved all the problems that plagued its larger competitor. “Of course we were skeptical and didn’t really believe them,” Damphousse recalls with a laugh.

But using A/B, WePay could present Damphousse with an irresistible proposition: Give us 10 percent of your traffic and test the results against PayPal in real time. It was an almost entirely risk-free way for the startup to prove itself, and it paid off. After Damphousse saw the data on the first morning, he switched half his traffic by the afternoon—and all of it by the next day.

Photo: Spencer Higgins

The person at the top makes the call.

Data makes the call.

Google insiders, and A/B enthusiasts more generally, have a derisive term to describe a decisionmaking system that fails to put data at its heart: HiPPO—”highest-paid person’s opinion.” As Google analytics expert Avinash Kaushik declares, “Most websites suck because HiPPOs create them.”

Tech circles are rife with stories of the clueless boss who almost killed a project because of a “mere opinion.” In Amazon’s early days, developer Greg Linden came up with the idea of giving personalized “impulse buy” recommendations to customers as they checked out, based on what was in their shopping cart. He made a demo for the new feature but was shot down. Linden bristled at the thought that the idea might not even be tested. “I was told I was forbidden to work on this any further. It should have stopped there.”

Instead Linden worked up an A/B test. It showed that Amazon stood to gain so much revenue from the feature that all arguments against it were instantly rendered null by the data. “I do know that in some organizations, challenging an SVP would be a fatal mistake, right or wrong,” Linden wrote in a blog post on the subject. But once he’d done an objective test, putting the idea in front of real customers, the higher-ups had to bend. Amazon’s culture wouldn’t allow otherwise.

Siroker recalls similar shifts during his time with the Obama campaign. “It started as a pretty political environment—where, as you can imagine, HiPPO syndrome reigned supreme. And I think over time people started to see the value in taking a step back and saying, ‘Well, here’s three things we should try. Let’s run an experiment and see what works. We don’t know.’”

This was the culture that he had come from at Google, what you might call a democracy of data. “Very early in Google’s inception,” Siroker explains, “if an engineer had an idea and had the data to back it up, it didn’t matter that they weren’t the VP of some business unit. They could make a case. And that’s the culture that Google believed in from the beginning.” Once adopted, that approach will beat the HiPPOs every time, he says. “A/B will empower a whole class of businesses to say, ‘We want to do it the way Google does it. We want to do it the way Amazon does it.’”

Says WePay’s Bill Clerico: “On Facebook, under the heading of Religious Views, my profile says: ‘In God we trust. All others, bring data.’”

Saturday, April 28, 2012

A father's lament: The real world is not a game | Internet & Media - CNET News

There was something about the Mama Bear family tech conference a week ago that creeped me out. I am the father of a 5-year-old boy, and perhaps a third of the people at this conference were trying to build apps for him. All the apps were well-intentioned. All were, at some level, educational.

Still, all the apps felt wrong to me. I wanted my son to have nothing to do with any of them.

I've been trying to understand why these educational apps were getting under my skin to this extent. It's not like I'm anti-technology when it comes to my child. He plays Angry Birds. We watch TV (together). He's a child of technology; how could he live in my house and not be?

A psychiatrist friend, listening to me rant about how these apps are trying to wilt my son's brain, sympathized, but not completely. Yes, he said, computer games can be addictive. In fact, in his opinion, teaching kids to expect the world to work like a computer game deprives them of learning real-world life skills.

But, he said, a truly good educational app can be effective like a book, or a teacher. You can't stick everything that pops up on a kid's iPad into the "evil" category.

So where are the really good apps?

The Vinci Tab II is an Android tablet preloaded with educational software for kids up to 5 years old.

(Credit: Rafe Needleman/CNET)A few days ago, I handed my son a Vinci tablet to try out. This is another well-intentioned product for young children. It comes with pre-installed educational games carefully geared to kids up to about my son's age (actually he's a little old for it, but I occasionally make him earn his keep as a product reviewer).

I had the same feeling of foreboding about this product as I did about many children's apps I see. The Vinci reinforced this, unfortunately. While the game did in fact have educational payloads, the mechanics were, for the most part, dumb. How does pressing a button at exactly the right time to jump over a beach ball on-screen teach anything but how to operate a game, no matter what the game says it's supposed to be about?

The boy liked the tablet and its apps. But it's how he liked them that bothered me. The software sucked him in, and whatever lessons it tried to teach him were obstacles that seemed about as interesting as the flatly drawn beach balls. The real red flag came when I told my boy it was time to put the tablet down. He was so dialed in to the game mechanics that he panicked. He wasn't in learning mode, he was in addiction mode.

Did he retain the factoids and basic math and spelling skills he learned while playing? I think so. But I don't want him learning this way.

There is hope, though.

On the DIY app, kids snap pictures of their projects. On the Web site, shown, family and friends can award badges.

(Credit: Screenshot by Rafe Needleman/CNET)Yesterday, I read about the launch of DIY, a site and app for kids that's supposed to be a social destination for them to share their creative projects. They upload photos of stuff they've designed, built, written, or drawn, and then their friends and family members can award them badges.

Something about this site appealed to me as a father. Why was it better than all the learning games, with their impressive educational pedigrees? I couldn't put my finger on it. So I called up DIY's CEO, Zach Klein (formerly of Vimeo). Klein isn't a father himself, but he understands the child's mind. In a few words he crystalized for me what I find distasteful about most kids' programming.

"They are gravity-fed," he says. "There's a path of least resistance to get to the next screen." The player's job is to find that path, he says. Games like this "infantilize children."

The real world doesn't work like this. There are no shortcuts in life. You don't get a big reward for each tiny action. Real rewards take real work.

Related stories

DIY, he says, "gives children more responsibility than they are used to, not less." And the rewards aren't programmed. They come from peers and family. "We want kids to feel satisfaction, but we're suggesting it will take time and craft and love to earn it."

DIY is in a very early stage, and is too basic at the moment. In the interest of protecting kids, there's no personal information anywhere on the system; kids' identities are masked behind handles, and if a family member awards a kid a sticker, the kid can't see who it came from. But the thinking of DIY is right, at least to me: Encourage kids to engage with the real world. Use social-networking mechanics to reinforce it.

I loaded the DIY app on to my old iPhone 3G. I plan to let my boy use the app on this device without supervision. It's the first app I've seen that passes that test for me. I'm not sure he'll use it, but I bet he will. And I like it, because it's an accessory to his physical world, not a replacement for it.

This is an excellent article if you are interested in educational games for your kids. The best line is the description of most games:

"They are gravity-fed," he says. "There's a path of least resistance to get to the next screen." The player's job is to find that path, he says. Games like this "infantilize children."

Thursday, April 26, 2012

The Decline Of Android Foretells The Rise Of A Total Apple Monopoly | TechCrunch

I own an Android phone right now as well and completely concur with Matt's assertions around Android.

Tuesday, April 24, 2012

The Art of the Pivot

Very interesting article, with examples, of companies that have successfully pivoted from their original business model. It would be just as interesting to hear of pivots that didn't succeed but alas that would probably not get the same amount of click-throughs:

http://www.inc.com/magazine/20110201/the-art-of-the-pivot.html

Take Charge Product Management © | Advancing the Profession of Product Management ™

The project manager / product manager relationship

Sure we know that effective collaboration leads to improved outcomes and more effective teamwork. But what specific functional collaborations are key in triggering creativity, problem solving, fostering further team communication, and ultimately improving project outcomes? Just putting everyone together in a room at project inception doesn’t necessarily guarantee success.

From my experience, the most successful product development projects were those that had the product manager and project manger tightly coupled from the very beginning. Spending more time developing this relationship from the onset will pay dividends and increase the likelihood of project success.

If we can agree that the goal of a product development project is to create, develop, and deliver a product to the market, maximizing its value – the customer benefit and experience – while ensuring the return on investment (ROI). Then, nothing ensures maximizing ROI more than getting the definition correct at the onset of a project. Knowing where you’re going and how to get there, at the beginning of the life cycle, eliminates waste by avoiding unnecessary course corrections throughout a project.

Leveraging the expertise of project managers at the earliest phases of a project helps to get this definition correct by bringing their best practices and lessons learned to the table at a critical juncture – the start of the project. Engaging project managers early has additional benefits: (1) Project ownership is now ingrained into its leaders because they have helped shape the execution approach; (2) By working together to form the overall project definition in the beginning of its life cycle, the foundation of a team dynamic is put in place that spills over into the rest of the project organization as it is put together.

Product managers and project managers can strengthen this relationship by understanding three fundamental concepts from the beginning of every project:

- The product development and project life cycles are deeply intertwined

- The product’s production process needs to be collaboratively defined with clarification of the major deliverables and resources required to get the job done

- Shared incentives, performance objectives, and success criteria establish common ground for the entire team

Each one of these three concepts warrants its own discussion so I’m going to treat each one of these as separate blog postings. This should allow for more focused commentary allowing the concepts to be completely hashed out.

Monday, April 23, 2012

The Slow Decay Of The Microsoft Consumer | TechCrunch

Five years ago, Microsoft reported revenue of $14.398 billion. They reported a profit of $6.589 billion. Last week, for the same quarter, Microsoft’s revenue was $17.407 billion. Their profit was $6.374 billion. The company is still growing, but not fast. And they’re actually making less money.

Compare that with Apple. Five years ago, revenue was $7.1 billion. Profit was $1.0 billion — the first quarter with a billion dollar profit in company history. Last quarter, the company reported $47 billion in revenue. And they recorded $13 billion in profit.

On the surface, an apples-to-oranges comparison, perhaps. But it points to something that has happened. Apple has completely taken over the consumer market, while most of Microsoft’s growth these days comes from the enterprise side of things. Apple has destroyed Microsoft as a consumer technology company.

Sure, Microsoft is still making plenty of money — billions — off of their consumer goods. But the decent quarterly numbers they reported last week in some ways mask what is really happening: Microsoft is slowing morphing into a full-on enterprise company.

Everyone got all excited that the Windows division actually managed to grow last quarter. Because the broader PC market has been stagnant and Windows 8 is in testing mode, expectations were extremely low. 4 percent growth was considered a big win.

But Microsoft as a whole saw 6 percent growth year-to-year when it came to revenue. It wasn’t Windows driving it, it was the Business Division (9 percent growth) and the Servers & Tools Division (14 percent growth). Again, the enterprise side of things.

The Business Division is now by far the largest Microsoft division in terms of revenue. Meanwhile, Servers & Tools almost surpassed the Windows Division this past quarter. The last time that happened was the tail end of the Vista nightmare. It’s going to happen again. Microsoft’s two biggest businesses will be their enterprise businesses.

Even on the Windows side of the equation, this was the key statement in the earnings release:

Strong Windows 7 adoption continued with enterprise desktops on Windows 7 now up to 40% worldwide.

Nothing about the consumer side of Windows, just the enterprise side. That’s what led to the 4 percent growth surprise.

Windows 8 is due out at the end of the year, and I’m sure the Windows Division revenue numbers will jump as a result. But as these charts by Horace Dediu show, the jump is likely to be short-lived. Microsoft saw a huge revenue (and profit) spike when Windows 7 was released, then it immediately dropped and plateaued. It was back to the revenue grind and the profit stagnation.

Windows 8 could be better for the company, or it could be worse. The world is drastically different than it was even just three years ago. The iPad exists, for one. While Microsoft is going all-in (or at least half-in) on their tablet strategy with Windows 8, there’s no indication it will actually work. If it doesn’t that could significantly hurt the Windows Divisions’ numbers.

Another key difference over the past five years is, of course, the iPhone. Five years ago, no consumer had one. Microsoft controlled nearly 35 percent of the U.S. smartphone market. It was going to be a huge business for them. Today, that percentage stands at roughly 5. And even with Windows Phone, it’s shrinking, as Dan Frommer points out today.

Microsoft’s last-ditch attempt insert themselves into the mobile picture isn’t working. At least not yet.

Consider this: Apple’s iPhone business alone is bigger than all of Microsoft’s businesses combined.

And that matters because again, that’s where consumers are today. Smartphones. Tablets. The PC business is going nowhere. Let’s just admit it: that’s not going to change.

The wildcard is the living room. This is the one consumer space where Microsoft has done better than Apple over the past 5 years. The Xbox 360 has been a big hit, and accessories like the Kinect have moved the market forward. Apple’s first Apple TV was largely a dud. The second one is much better and seems to be selling well, but it’s not a consumer hit in the same way the Xbox is.

But last quarter, a funny thing happened: Microsoft’s Entertainment and Devices Division actually lost money. That had not happened since 2009. And it was the worst loss since 2007 — again, five years ago.

Since Microsoft reports Windows Phone numbers under E&D, some assumed the poor numbers were a result of things like Microsoft’s Nokia payout dragging the division down. But Microsoft themselves noted that the 16 percent decrease in revenue was the result of “a soft gaming console market”. This was later backed up by more numbers. The drop in revenue and the swing to a loss was all about Xbox demand evaporating.

Now, obviously, the Xbox is old — some may say “ancient” by gaming console standards. And a new one isn’t due until next year. That device will undoubtedly do well, but you have to wonder if Microsoft wasn’t surprised by this swift drop to a loss for the division. If they weren’t, why not aim for a new console this year? It sure seems like they were counting on things like the Kinect to extend the life of the device, and that worked for a while, then collapsed.

Meanwhile, gaming on iOS continues to grow. Anyone who doesn’t view the iPad as a legitimate living room gaming contender now is simply fooling themselves. And it’s a device that’s refreshed with the lastest hardware once a year. The Xbox is coming in three, four, or even five year intervals. That simply cannot compete given the rate of change we’re seeing.

Microsoft is smart to move more into the broader entertainment space, securing content deals for the Xbox. But again, Apple will be there as well. At first through the existing Apple TV (with a killer assist from the AirPlay functionality). Down the road, perhaps with their own actual television.

And then there’s the Online Service Division. Despite their “operating loss improvement“, they lost another $479 million last quarter. The total losses for the division over time are approaching $10 billion as they chase Google down a rabbit hole to claim a consumer market they’re never going to win.

To me right now, Microsoft’s consumer business feels like Nokia’s smartphone business a few years ago: the numbers look fine, and in some cases even good, but the world is quickly changing. If you just look at the past five years of what Apple has done versus what Microsoft has done, it’s not hard to imagine Microsoft’s business being completely dominated by the enterprise side of the equation in another five years. That will still make for a great business, but it’s not the Microsoft that many of us have known.

Everyone you know goes away in the end, I suppose.

Learn moreMicrosoft, founded in 1975 by Bill Gates and Paul Allen, is a veteran software company, best known for its Microsoft Windows operating system and the Microsoft Office suite of productivity software. Starting in 1980 Microsoft formed a partnership with IBM allowing Microsoft to sell its software package with the computers IBM manufactured. Microsoft is widely used by professionals worldwide and largely dominates the American corporate market. Additionally, the company has ventured into hardware with consumer products such as the Zune and...

This puts Microsoft's current position into perspective...

Thursday, April 19, 2012

Into The Wild: Lost Conversations From Steve Jobs' Best Years | Fast Company

One way to drive fear out of a relationship is to realize that your partner's values are the same as yours, that what you care about is exactly what they care about. In my opinion, that drives fear out and makes for a great partnership, whether it's a corporate partnership or a marriage.via fastcompany.comSteve Jobs quote from a great article...

Monday, April 16, 2012

Some of Mom's Old Photos

It's great to be able to look at these old photos of my Mom and her family.

Created with Admarket's flickrSLiDR.

Sunday, April 15, 2012

Kids in Victoria - ChatterBlock

Welcome to ChatterBlock!

As a busy parent, finding local events and activities for your kids and family should never be a chore. With ChatterBlock, setting up your clan with great programs, drop in events and camps can be efficient, social and fun!</p> <p>Based in Victoria, BC, ChatterBlock is a social media company built specifically for busy parents. ChatterBlock is a place to discover and learn about activities, resources and events happening in your community, allowing you to connect and share with other families and friends along the way.</p> <p>So, just what can ChatterBlock help you with?</p> <div class="help"> <ul> <li>Discover family-friendly events in Victoria BC and surrounding activities</li> <li>Search and browse a very large selection of programs and camps for your children</li> <li>Find drop-in schedules for all the major recreation centres, in one place</li> <li>Track what activities you’re attending (click I’m In) or short listing (click Maybe)</li> </ul> </div> <p>Share event and program ideas with your family and friends – because as we all know, the more the merrier!</p></blockquote>If you are a parent in Victoria or the San Fran area, this is the site for you! Check it out at http://http://www.chatterblock.com/kids-in-victoria/#

Saturday, April 07, 2012

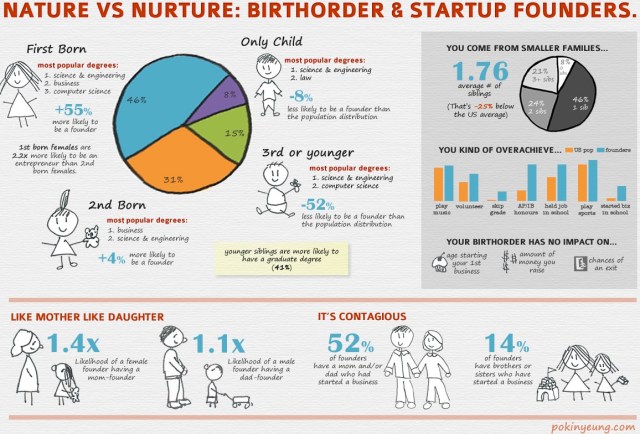

Why You’re A Startup Founder: Nature And Nurture | TechCrunch

Editor’s note: Pokin Yeung founded two startups, GeckoGo and Askomatics, and is currently blogging and helping out various other startups. Follow her on Twitter @pokin.

Just over a month ago, a random conversation with another startup founder over lunch turned into a full-blown research project.

“You and I are both first-born children,” I mused to my friend, “I wonder if that had any influence on why we chose to start businesses.”

I theorized that first borns were often given more responsibility growing up, and wondered if this role served as training wheels for building startups. I also wondered if our upbringing had an influence on things like when we start, what we start, or how much money we raise — and ultimately, how successful we are with our businesses.

Four weeks, a survey of 318 founders, and a lot of data-crunching later, here are my conclusions:

Family Matters

- Your birth order does influence the likelihood you will be a founder.

If you’re a first-born, you are more likely to be a founder — 55 percent more likely than the population distribution. Just under half (46 percent) of our founders were first-born children, and I fit into this category. If you come from a two-child family, this effect is larger. You’re 63 percent more likely to be a founder than the second born child.- If you’re female, this effect is huge.

Female first-borns are 118 percent more likely than second-born females to be founders if they come from a two-child family. I fit into this category, too. Maybe the capricious nature of sibling relationships combined with the leadership (read: guess-who’s-in-trouble-if-something-happens-to baby-sis) role gives us more comfort in the rock-and-roll world of starting companies.- Second-born children are slightly more likely than the general population to be founders, but beyond that the chances actually decrease.

- Third-born or later children are 52 percent less likely to be a founder.

- Only children are underrepresented, and it’s statistically significant. Only children have been described as “First Borns on Steroids.” They are typically more likely to become CEOs and be hyper-achievement oriented. Yet they are underrepresented in our study. Could it be that only children prefer to rule larger, more established companies? Or is it something about the uncertain dynamic of having siblings to fight with that gives first borns the skills and motivation to take the leap?

- There is no correlation between your birth order and your chance of raising money or having a successful exit.

Startups run in the family

The data suggest that your parents can shape your inclination to become a founder – especially if your mom was an entrepreneur and you’re a girl. Female entrepreneurs are 1.4 times more likely to have a mom who was also a founder. Over 50 percent of our founders surveyed have a parent who had also started a business, and 14% of respondents have a brother or sister who’s taken the leap. So it seems having a good role model matters — especially for females. Organizations like Women 2.0 are a good start, and more access to mentorship programs during the formative years could make a big difference in bringing more female founders into play.

Higher education or trial by fire?

Startup founders have to do a lot of multi-tasking, but two things that don’t seem to mix are school and startups. Most founders tend to wait till school is done before starting their first business. In general, by the time founders are 25

- 74 percent of you had started a business if you didn’t have a college degree.

- 55 percent if you had a bachelor’s degree.

- 24 percent if you had a graduate degree.

Also, 50 percent of you waited till after 30 to start your first business if you had a graduate degree.

How else do you compare against the population? For starters, you overachieve.

Startup founders in general tend to overachieve. You are 6.4 times more likely to have skipped a grade, and 6 times more likely to start some sort of business endeavour (selling candies, anyone?) while still in school. Across the board, startup founders are more likely to more likely to do things like play sports, play a musical instrument, or hold a part-time job while still in high school. Maybe it’s a desire for learning, general well-roundedness and drive for growth that creates the motivations for founders to strike out on their own? Or maybe it’s a curiosity about the world. Lots of potential theories and areas of further research.

So what next?

The specific circumstances that push founders to take the leap definitely involves more than the sequence in which founders arrive to their families, but it does seem clear that once you become a founder, you stand to quite strongly influence future generations to come.

There were other interesting areas of research, including the types of adversity faced by startup founders growing up, and it’s what I want to dig into next. If anyone is interested who didn’t participate in my study before, I’d love to ask you some questions here.

Monday, April 02, 2012

AmEx Swipes Neal Sample From eBay for Digital Payments Push - Tricia Duryee - Commerce - AllThingsD

American Express has lured Neal Sample away from eBay to become SVP of technologies for its digital payments initiative.

Called

Serve, it is competing head-on with eBay’s own PayPal, as American Express attempts to expand its audience beyond briefcase-toting corporate users.

At eBay, Sample was the CTO of X.commerce, the open commerce platform the company unveiled late last year that gives technology tools to retailers at no cost. Prior to eBay, Sample was a senior executive at Yahoo, where he led the open, social and participation platforms. He left Yahoo in August 2010.

Sample’s technical expertise is focused on developing and building platforms and products for emerging technologies.

Serve is a complex platform that allows consumers to make purchases, take cash withdrawals from ATMs and make person-to-person payments from their computer or their phone.

The offering is fairly complex because it can be funded by a user’s bank account or credit or debit card — even from one of the company’s major competitors, like Visa or MasterCard.

In the future, American Express envisions expanding the platform to mobile phones, using near field communication or other technology.

Given eBay and PayPal’s extensive knowledge in the digital payments arena, many of its executives have left the company to explore the endless number of opportunities sprouting up.

Recently, Alyssa Cutright, a 12-year veteran of PayPal, left to join Square, a payments company in San Francisco; and of course, PayPal President Scott Thompson left at the end of last year to join Yahoo as CEO. Last week, eBay named David Marcus as his replacement.